Corporate Housing Arbitrage: The Superior Passive Income Avenue in Real Estate

Why Corporate Housing Arbitrage Outshines Traditional Rental Models

There’s a burgeoning model that’s catching the attention of savvy investors: Corporate Housing Arbitrage. This model, while not entirely new, is rapidly gaining traction as a more profitable alternative to traditional long-term rentals. But what exactly is Corporate Housing Arbitrage, and how does it promise higher returns?

What is Corporate Housing Arbitrage?

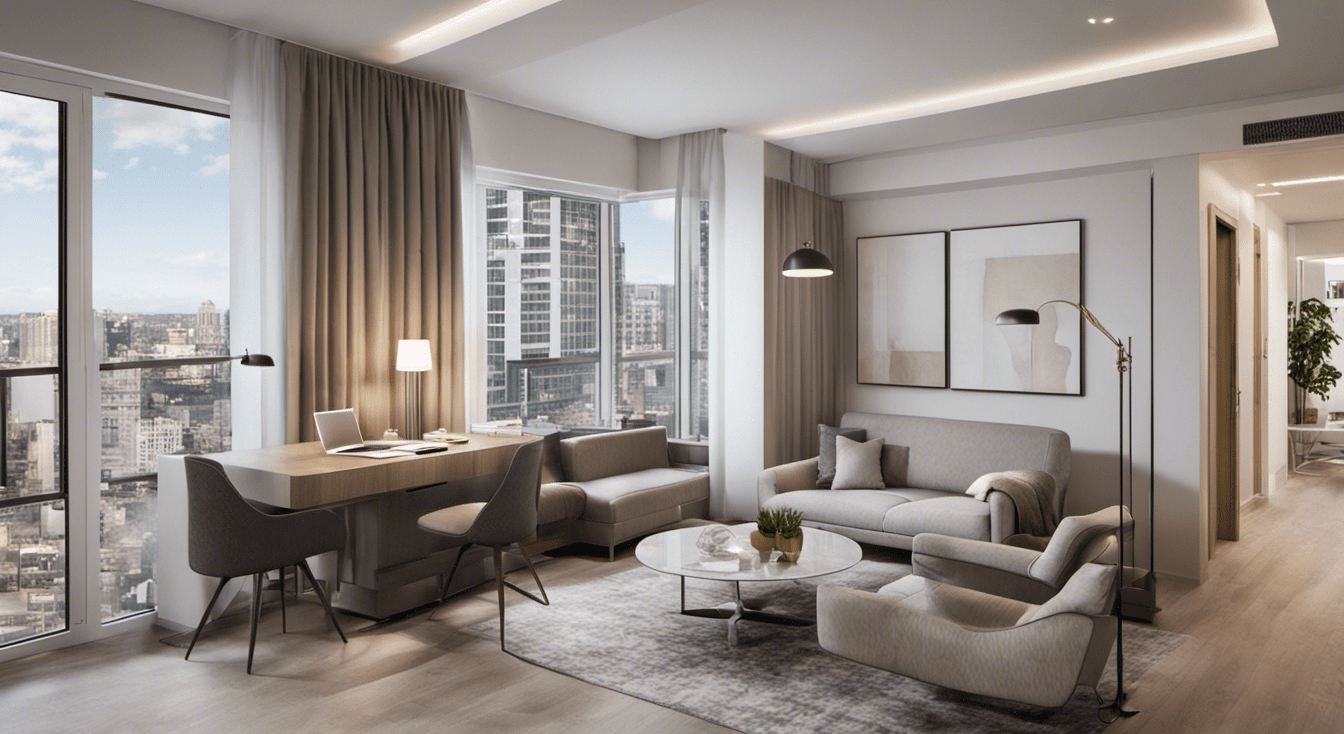

Corporate Housing Arbitrage is a business model where an individual or company leases a property, typically an apartment, and then sub-leases it at a higher rate to business professionals or corporations for short to medium-term stays. These stays can range from 30 days to 12 months, effectively bypassing many short-term rental regulations.

Why Corporate Housing Arbitrage is More Profitable:

- Leverage:

Unlike traditional real estate where you need to own multiple properties to scale, with Corporate Housing Arbitrage, you can control numerous properties without owning them. This means less capital tied up in property acquisition and more liquidity for other investments. - Higher Profit Margins:

Companies like HlH Stay have reported profit margins of 30-40%. This is because they can charge premium rates for fully serviced apartments, which are often in high demand by corporate clients. - Quality Clients:

Corporate housing typically attracts business professionals, executives, and corporations. This means less wear and tear on the property and timely payments. - Low Entry Cost:

Since you’re not purchasing the property, the initial investment is significantly lower. You’re essentially investing in furnishing and setting up the apartment, which is a fraction of the cost of buying a property. - Low Marketing Costs:

With platforms dedicated to corporate housing and the inherent demand from businesses, the marketing costs are often lower than traditional rental models.

Case Study: HlH Stay

HlH Stay, a prominent player in the corporate housing sector, has effectively utilized the arbitrage model. By renting corporate apartments, they maintain consistent bookings and realize impressive profit margins. Their strategy of offering fully serviced apartments allows them to charge premium rates, further enhancing profitability.

Q: How does Corporate Housing Arbitrage bypass short-term rental regulations?

A: Since guests typically stay from 30 days to 12 months, these rentals often fall outside the purview of short-term rental regulations, which usually target stays shorter than 30 days.

Q: Are there any risks associated with Corporate Housing Arbitrage?

A: Like any business model, there are risks. It’s essential to ensure that the primary lease allows for sub-leasing and to maintain a high standard of service to ensure repeat business.

Q: How does the quality of clients in Corporate Housing Arbitrage compare to traditional rentals?

A: Corporate housing generally attracts a more professional clientele, such as business travelers and executives, leading to fewer issues with property damage or late payments.

For investors seeking a lucrative passive income opportunity in real estate, Corporate Housing Arbitrage presents a compelling case. With its potential for high-profit margins, quality clientele, and lower entry and marketing costs, it’s a model that’s hard to overlook. As the real estate landscape evolves, those who adapt and leverage innovative models like this are poised to reap significant rewards.

Leave a Reply